State-level immigration laws don’t pay off. That’s the consensus from business and agricultural...

Get the Facts

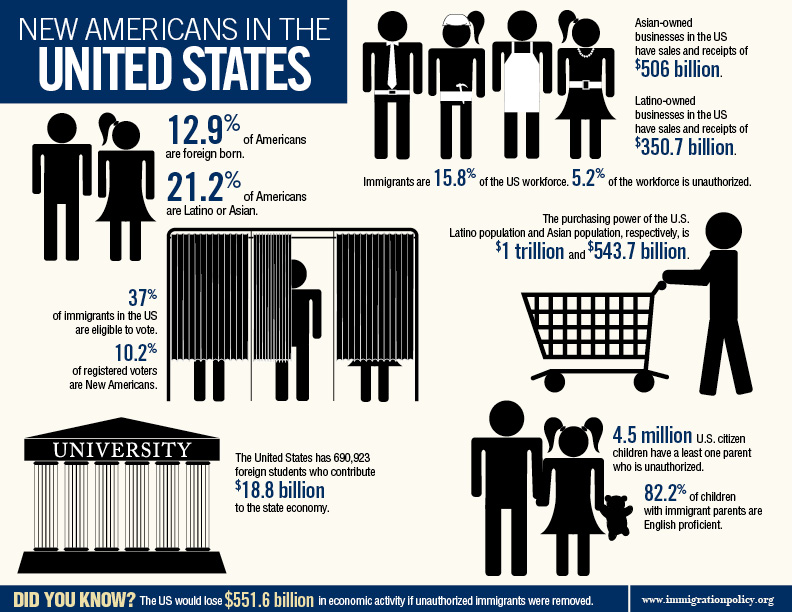

If all unauthorized immigrants were removed from the United States, the country would lose $551.6 billion in economic activity, $245 billion in Gross Domestic Product (GDP), and approximately 2.8 million jobs.

IPC in the News

Unreliable databases could cost even citizens their jobs

-

06/07/12

Nearly everyone agrees that our immigration system is broken and in desperate need of reform....

The Political and Economic Power of Immigrants, Latinos, and Asians in the United States (Updated January 2012)

The Political and Economic Power of Immigrants, Latinos, and Asians in the United States (Updated January 2012)